Why I Treat My Health Like an Investment Portfolio

What if the way you fuel your body could also grow your wealth? I used to see vitamins and supplements as just another monthly expense—until I started viewing them through an investor’s lens. This shift didn’t just improve my energy and focus; it reshaped how I think about long-term value. In this article, I’ll walk you through the smart, strategic way I approach nutritional spending—not as a cost, but as a high-return personal investment. By applying principles from finance such as risk assessment, return on investment, and portfolio diversification, I’ve transformed how I care for my body. And the results go beyond physical wellness—they ripple into every area of life, from work performance to financial decision-making. This isn’t about chasing trends or buying expensive pills. It’s about making deliberate, informed choices that compound over time, just like a well-managed retirement fund.

The Hidden Cost of Ignoring Your Nutrition

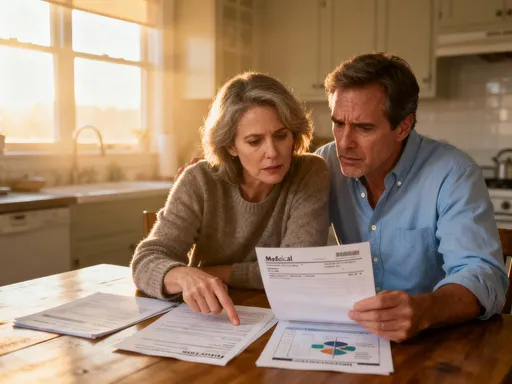

Poor nutrition may seem like a private matter, but its consequences extend far beyond how you feel after lunch. When you consistently skip balanced meals, rely on ultra-processed foods, or fail to correct nutrient deficiencies, you're not just compromising your health—you're eroding your financial potential. The economic toll of suboptimal eating habits is often invisible, accumulating slowly until it manifests in missed workdays, lower productivity, or chronic medical conditions. Consider the working mother who grabs fast food daily because she’s too busy to cook. Over time, this pattern can lead to fatigue, weight gain, and eventually, insulin resistance. These health setbacks don’t just affect her well-being—they impact her ability to manage household responsibilities, advance in her career, or save for the future.

Studies have shown that employees with poor diets are more likely to experience presenteeism—being at work but functioning below capacity. The cognitive effects of blood sugar swings and micronutrient deficiencies can reduce concentration, slow reaction times, and impair memory. For someone managing a home budget or balancing part-time work, these subtle declines can result in overlooked bills, delayed projects, or missed opportunities. The financial cost is real: one analysis estimated that poor dietary patterns contribute to over $50 billion annually in lost productivity in the United States alone. That’s not including medical expenses. Conditions like type 2 diabetes, heart disease, and hypertension—largely preventable through diet—are among the most expensive to treat over a lifetime.

Moreover, the burden isn’t limited to individuals. Families bear the indirect costs when a parent requires ongoing medical care or must reduce work hours due to illness. Prescription medications, doctor visits, and specialized treatments add up quickly, often straining household finances. What many fail to recognize is that these outcomes are not inevitable. They are the result of small, repeated choices that compound in the wrong direction. Just as compound interest can build wealth, poor daily habits can build debt—both financial and physiological. Viewing nutrition as a form of risk management helps reframe healthy eating from a luxury to a necessity. It’s not about perfection, but about consistency and foresight. The earlier you invest in your body’s foundation, the less you’ll pay in penalties later.

Reframing Supplements: From Expense to Asset

For years, I treated supplements like incidental purchases—something I’d pick up at the pharmacy when I felt run down. I saw them as temporary fixes, not long-term strategies. That changed when I began applying financial thinking to my health decisions. Instead of asking, “Do I really need this?” I started asking, “What return will this generate?” Suddenly, a bottle of omega-3s wasn’t just another item on my receipt—it was an investment in brain health, cardiovascular function, and inflammation control. Like buying shares in a company with strong fundamentals, certain supplements offer measurable, long-term benefits that outweigh their upfront cost.

The concept of human capital—your ability to generate income through skills, knowledge, and physical capacity—is central to personal finance. But few people realize that your body is the engine of that capital. If your energy is low, your focus scattered, or your immune system weak, your earning potential diminishes. Nutritional support helps maintain that engine. Take vitamin D, for example. Deficiency is linked to fatigue, mood imbalances, and increased susceptibility to infections. Supplementing, especially in regions with limited sunlight, can restore optimal function. The return? Fewer sick days, better mood regulation, and improved sleep—all of which contribute to greater efficiency in daily life.

Similarly, high-quality omega-3 fatty acids support cognitive performance and reduce systemic inflammation, a hidden driver of many chronic diseases. While you can obtain these nutrients from food, modern diets often fall short. Farming practices, soil depletion, and food processing have reduced the nutrient density of many common foods. Supplements, when chosen wisely, fill these gaps. They are not replacements for whole foods, but strategic additions—like diversifying a portfolio to reduce exposure to market volatility. When you view them this way, the cost becomes an investment in resilience. Over time, the benefits compound: sharper thinking leads to better decisions, stronger immunity reduces medical spending, and sustained energy improves productivity. These are not abstract gains—they translate directly into financial and personal outcomes.

Risk Management: Avoiding the Pitfalls of Poor Choices

Just as not every stock is a sound investment, not every supplement delivers value. The health and wellness market is filled with products that make bold claims but lack scientific backing. Some are ineffective; others may even cause harm if taken in excess or without proper guidance. This is where risk management becomes essential. In finance, due diligence protects your capital. In nutrition, it safeguards your health. Before adding any supplement to your routine, it’s critical to assess quality, dosage, and evidence. Third-party testing, transparent labeling, and clinical research should be your guiding criteria—just as you’d evaluate a company’s financial statements before investing.

One of the most common pitfalls is assuming that “natural” means safe. This is not always true. Certain herbal supplements can interact with medications, and excessive intake of fat-soluble vitamins like A, D, E, and K can accumulate to toxic levels. For instance, too much vitamin D can lead to hypercalcemia, a condition that affects the heart and kidneys. Similarly, unregulated “detox” blends or proprietary formulas with undisclosed ingredients pose unknown risks. These are the equivalent of speculative penny stocks—high risk, low transparency, and unpredictable returns. To avoid them, look for products certified by independent organizations such as USP, NSF, or ConsumerLab, which verify purity and potency.

Another risk is over-supplementation. Some people take multiple products without understanding how they interact. For example, both fish oil and certain herbal supplements like ginkgo biloba have blood-thinning properties. Taking them together could increase the risk of bleeding, especially before surgery. This is where the principle of diversification applies—not in multiplying supplements, but in balancing them thoughtfully. A targeted approach, based on individual needs, is safer and more effective. Blood tests can identify deficiencies, allowing you to invest only where necessary. This eliminates waste and reduces exposure to unnecessary compounds. By treating supplementation like a disciplined financial strategy, you minimize risk while maximizing health returns.

Diversification in Your Daily Routine

In investing, putting all your money into a single stock is risky. The same principle applies to nutrition. Relying on just one supplement or nutrient group leaves you vulnerable to imbalances and missed opportunities. A well-structured health portfolio spreads support across multiple systems—brain, gut, immune function, energy metabolism—ensuring that no single area becomes a weak link. Just as a balanced financial portfolio includes stocks, bonds, and real estate, a comprehensive nutritional strategy combines foundational supplements with situational ones tailored to life’s changing demands.

Foundational nutrients are the core holdings of your health portfolio. These include vitamin D, omega-3 fatty acids, magnesium, and a high-quality multivitamin. They support basic physiological functions and address common deficiencies in modern diets. Vitamin D, for instance, plays a role in immune regulation and bone health, while magnesium is involved in over 300 enzymatic reactions, including those that regulate sleep and stress response. Omega-3s support brain structure and reduce inflammation. These are not flashy investments, but they provide steady, long-term returns in resilience and function.

Situation-specific supplements act like tactical allocations—adjustments made in response to life’s fluctuations. During periods of high stress, adaptogens like ashwagandha or rhodiola may help regulate cortisol levels and improve mental endurance. When traveling or facing seasonal changes, immune-supportive nutrients like zinc, vitamin C, or probiotics can provide extra protection. Sleep quality often declines with age or hormonal shifts, making melatonin or magnesium glycinate valuable tools. The key is to use these strategically, not habitually. Overuse can lead to dependency or reduced natural production. By rotating or adjusting based on need, you maintain balance and avoid overloading your system.

Synergy between nutrients also enhances returns. For example, vitamin D absorption improves when taken with vitamin K2 and healthy fats. B vitamins work together in energy metabolism, so taking a complex is more effective than isolating one. This interconnectedness mirrors the way asset classes influence each other in a portfolio. A diversified approach ensures that your body’s systems operate in harmony, reducing strain and improving overall efficiency. Consistency matters more than novelty—sticking with proven nutrients yields better results than chasing the latest trend.

Measuring Returns: Tracking Energy, Focus, and Resilience

In finance, success is measured by returns: portfolio growth, dividend income, or risk-adjusted performance. In health, the metrics are different but equally important. How much energy do you have in the afternoon? How quickly do you recover from a busy week? Can you focus during important tasks without mental fog? These are the indicators of your body’s performance, and they can be tracked just like financial statements. The challenge is that health returns are often subtle and cumulative, making them easy to overlook. But with intentional observation, you can see the impact of your nutritional investments.

One of the most effective tools is a daily journal. Recording how you feel each morning—energy level, mood, digestion, sleep quality—creates a baseline for comparison. Over time, patterns emerge. You might notice that on days you take omega-3s, your focus is sharper during work calls. Or that when you maintain consistent magnesium intake, you fall asleep faster and wake up refreshed. These observations validate your choices and reinforce commitment. They also help identify what’s working and what’s not, allowing you to adjust your regimen like a financial advisor rebalancing a portfolio.

Objective measures can also be useful. Some people track resting heart rate, sleep duration via wearable devices, or even cognitive performance using simple memory or reaction time tests. Blood work provides concrete data on nutrient levels, inflammation markers, and metabolic health. These are like quarterly reports—they offer a snapshot of your internal environment. When combined with subjective feedback, they create a comprehensive picture of return on investment. For example, lowering CRP (a marker of inflammation) through diet and supplements may not feel dramatic, but it reduces long-term disease risk, much like reducing portfolio volatility improves long-term stability.

The most powerful returns are often indirect. Better sleep leads to clearer thinking, which improves decision-making at work or in managing household finances. Reduced fatigue means more patience with children or better engagement in relationships. These benefits may not appear on a balance sheet, but they enrich life in meaningful ways. And because they compound, small daily improvements can lead to significant long-term gains. Just as compound interest grows wealth silently over decades, consistent health habits build resilience quietly over time.

Smart Spending: Where to Invest and Where to Cut

With thousands of supplements on the market, it’s easy to overspend on products that offer little value. Marketing claims, celebrity endorsements, and attractive packaging can trick even careful consumers into paying premium prices for underperforming formulas. This is where financial discipline becomes essential. Just as you wouldn’t buy a mutual fund based solely on its name, you shouldn’t choose a supplement based on its label. The goal is to allocate your health budget wisely—focusing on high-impact, evidence-based nutrients while eliminating waste.

Start by prioritizing essentials. Vitamin D, omega-3s, magnesium, and a basic multivitamin are supported by extensive research and address widespread deficiencies. These should form the foundation of your regimen. Next, consider your individual needs. Are you under chronic stress? Low on energy? Prone to colds? Targeted supplements like adaptogens, B-complex, or probiotics may be worth the investment. But avoid piling on multiple products without a clear purpose. More is not always better. Each additional supplement increases complexity and cost, and may introduce interactions or digestive discomfort.

Also, recognize when food can replace pills. A diet rich in fatty fish, leafy greens, nuts, and whole grains provides many of the nutrients you might otherwise supplement. For example, eating salmon twice a week can supply adequate omega-3s for most people, reducing the need for fish oil. Fermented foods like yogurt or kimchi support gut health, potentially lowering reliance on probiotics. This doesn’t mean supplements are unnecessary—modern lifestyles and food systems often make it difficult to meet all needs through diet alone—but it does mean you should use them strategically, not automatically.

Price doesn’t always reflect quality. Some expensive brands charge more for branding, not efficacy. Look for transparency: Does the label list exact dosages? Are ingredients backed by research? Is the product third-party tested? These factors matter more than marketing. Buying in bulk from reputable online retailers or subscription services can also reduce costs without sacrificing quality. The goal is not to spend less, but to spend wisely—ensuring every dollar supports a measurable health outcome. This is the essence of financial prudence applied to personal wellness.

Building a Long-Term Health Investment Plan

Sustainable wealth isn’t built overnight. It requires patience, discipline, and a long-term perspective. The same is true for health. Quick fixes and short-term solutions rarely last. Lasting well-being comes from consistent, intentional choices that compound over time. By integrating nutritional investing into your broader lifestyle and financial strategy, you create a foundation for lifelong resilience. This isn’t about achieving perfection—it’s about progress, awareness, and stewardship of your most valuable asset: yourself.

Begin by setting clear goals. Do you want more energy? Better sleep? Stronger immunity? Reduced stress? Define what success looks like, then align your supplement and dietary choices accordingly. Just as a financial plan includes budgeting, saving, and risk management, your health plan should include daily habits, monitoring, and periodic reviews. Reassess every few months—adjust based on how you feel, seasonal changes, or new health information. This keeps your strategy dynamic and responsive.

Integrate this mindset into family life. When you model thoughtful health choices, you teach your children the value of self-care and prevention. Preparing balanced meals, choosing quality supplements, and prioritizing rest become normal, not exceptional. These habits shape a home environment where wellness is a shared priority. And because health affects every aspect of life—from emotional stability to financial security—this investment pays dividends across generations.

In the end, the smartest investment you can make is in your own body. No stock, real estate, or business venture will matter if you lack the energy, clarity, and vitality to enjoy it. By treating your health like a portfolio—diversified, monitored, and managed with care—you protect your future and enhance your present. The returns aren’t just measured in years added to life, but in life added to years. That’s a yield worth pursuing.