How I Tamed Medical Costs in Today’s Wild Healthcare Market

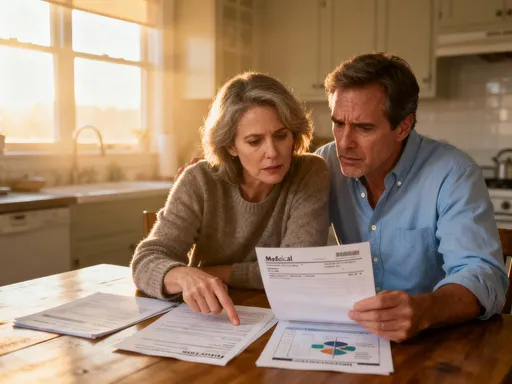

Remember that sinking feeling when a medical bill shows up out of nowhere? I’ve been there—staring at charges I didn’t expect, wondering how to stay protected without breaking the bank. With healthcare prices shifting faster than ever, I dug into real strategies that actually work. This is my story of navigating rising medical costs, spotting market trends, and building a smarter financial safety net—all through practical, tested methods that could help you do the same. It’s not about becoming a financial expert overnight. It’s about making steady, informed choices that add up over time. And for many of us, especially those managing household budgets or planning for retirement, the peace of mind that comes from preparation is worth more than any dollar amount.

The Shocking Rise of Medical Expenses

Over the past two decades, the cost of healthcare in the United States has climbed at a pace far exceeding general inflation. According to data from the Centers for Medicare & Medicaid Services, national health expenditures grew by an average of 4.5% annually between 2010 and 2022, consistently outpacing overall economic growth. For the average family, this means that premiums, deductibles, and out-of-pocket costs now consume a larger share of income than ever before. A routine emergency room visit that once cost a few hundred dollars can now lead to bills exceeding $2,000—even for insured patients. Prescription medications, especially specialty drugs for chronic conditions like diabetes or autoimmune disorders, have seen double-digit price increases in recent years, placing added strain on long-term budgets.

What makes this trend particularly concerning is its unpredictability. Unlike housing or transportation, healthcare expenses often arrive without warning. A sudden diagnosis, an unexpected injury, or even a follow-up test can trigger a chain of charges that accumulate quickly. Consider the case of chronic conditions, which affect nearly half of all American adults. Managing hypertension, arthritis, or asthma isn’t a one-time cost—it’s an ongoing financial commitment that includes regular doctor visits, lab work, imaging, and medications. Over time, these recurring expenses can erode savings, especially if insurance doesn’t cover all services or if patients face high co-pays.

This reality has transformed how families must think about financial planning. Medical costs are no longer a secondary concern—they are a central pillar of household economics. Ignoring them is no longer an option, especially as life expectancy increases and the likelihood of needing significant medical care later in life grows. The good news is that while we can’t control when illness strikes, we can take deliberate steps to reduce financial exposure. The key lies in understanding not just the cost of care, but the systems behind it—and how to navigate them wisely.

Understanding Today’s Healthcare Market Dynamics

The modern healthcare landscape is shaped by powerful structural shifts that directly influence what patients pay and how they access care. One of the most significant trends is the consolidation of hospitals and medical practices. As smaller clinics merge into larger health systems, patients often find themselves with fewer choices and less negotiating power. Studies have shown that in markets with limited competition, prices for procedures like imaging, surgeries, and even routine lab tests can be significantly higher. This means that even with insurance, individuals may face elevated costs due to the lack of price transparency and competitive pressure.

At the same time, digital health solutions are reshaping access and affordability. Telemedicine, once a niche option, has become a mainstream part of care delivery. Virtual visits are often less expensive than in-person appointments and can reduce travel, time off work, and exposure to illness. Many insurance plans now cover telehealth services at the same rate as office visits, making them a cost-effective option for minor ailments, mental health counseling, and chronic disease monitoring. Remote monitoring devices and mobile health apps also empower patients to track vital signs, medication adherence, and symptoms—potentially catching issues early before they require expensive interventions.

Employer-sponsored insurance continues to play a dominant role, but its structure is evolving. More companies are adopting high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) as a way to manage rising premiums. While these plans lower monthly costs, they shift more financial responsibility onto employees, especially in the early part of the year before deductibles are met. Additionally, some employers are introducing wellness incentives—offering premium discounts or cash rewards for completing health screenings or achieving fitness goals. These programs not only promote healthier lifestyles but also help reduce long-term medical spending for both employers and employees.

Another emerging trend is the rise of direct primary care (DPC) models, where patients pay a flat monthly fee for access to a primary physician. Though not a replacement for insurance, DPC can reduce out-of-pocket costs for routine care and foster stronger doctor-patient relationships. While still relatively small in scale, such innovations reflect a growing demand for more transparent, patient-centered pricing. Together, these dynamics underscore a critical point: the healthcare market is no longer static. To manage costs effectively, individuals must stay informed about how care is delivered, priced, and reimbursed.

Building a Financial Shield: Health Savings That Actually Work

One of the most powerful tools available to families is the Health Savings Account (HSA), a triple-tax-advantaged account designed specifically for medical expenses. To qualify, an individual must be enrolled in a high-deductible health plan. The benefits are substantial: contributions are made with pre-tax dollars, the funds grow tax-free through investment, and withdrawals for qualified medical expenses are also tax-free. For 2024, the IRS allows annual contributions of up to $4,150 for individuals and $8,300 for families, with an additional $1,000 catch-up contribution allowed for those aged 55 and older. These limits make HSAs a viable long-term savings vehicle, not just for immediate needs but for future healthcare costs in retirement.

What sets the HSA apart from other savings options is its flexibility and longevity. Unlike Flexible Spending Accounts (FSAs), which typically require funds to be used within a calendar year or be forfeited, HSA balances roll over indefinitely. This allows families to build a reserve over time, much like a retirement account. Many financial institutions now offer HSA investment options, enabling account holders to grow their balances through market gains. For those in good health and able to pay current medical costs out of pocket, the strategy of investing HSA funds and saving receipts for future reimbursement can maximize long-term value.

However, the effectiveness of an HSA depends on consistent funding and disciplined use. Treating it as a general savings account or dipping into it for non-medical expenses before age 65 can result in taxes and penalties. The key is to view the HSA as a dedicated financial shield—one that strengthens with each contribution. Even modest monthly deposits, such as $100 or $200, can accumulate significantly over a decade, especially when combined with compound growth. Automating contributions through payroll deduction ensures consistency and reduces the temptation to spend elsewhere.

For those without access to an HSA, FSAs remain a useful alternative. While they lack the rollover feature, they still offer tax savings on eligible expenses like prescriptions, dental care, vision services, and over-the-counter medical products. Some employers also offer dependent care FSAs, which can help offset costs for children or aging parents. The challenge with FSAs is timing—spending down the balance before the plan year ends requires planning. But when used strategically, both HSAs and FSAs can serve as essential components of a household’s financial defense against rising medical costs.

Smart Insurance Choices Beyond the Basics

Selecting the right health insurance plan is one of the most impactful financial decisions a family can make. Yet many people default to whatever is offered at work or choose based solely on monthly premiums, overlooking the long-term implications of deductibles, co-pays, and out-of-pocket maximums. A low-premium plan may seem attractive, but if it comes with a $7,000 deductible, the financial burden during a health crisis can be overwhelming. Conversely, a higher-premium plan with a lower deductible might offer better protection for those with ongoing medical needs, even if it costs more upfront.

The ideal approach is to match the plan to personal and family health patterns. For healthy individuals or families who rarely visit specialists or require hospitalization, a high-deductible health plan paired with an HSA can be a smart strategy. The lower premiums free up cash flow, while the HSA provides a tax-efficient way to save for future care. This combination also encourages mindful spending—since patients pay more out of pocket initially, they are more likely to compare prices, ask about generic medications, or seek second opinions before undergoing expensive procedures.

For those managing chronic conditions or expecting significant medical activity—such as surgery, pregnancy, or ongoing therapy—a plan with broader coverage and lower out-of-pocket costs may be more economical in the long run. It’s important to review not just the premium but the full cost structure, including which providers are in-network, whether preferred doctors participate, and what services require prior authorization. A single out-of-network test or specialist visit can result in surprise billing, where the patient is responsible for a large portion of the cost.

Medication coverage is another critical factor. Formularies—the list of drugs covered by an insurance plan—can vary widely. A medication that is fully covered under one plan may be excluded or require a high co-pay under another. Reviewing the formulary and using mail-order pharmacies or manufacturer discount programs can lead to substantial savings. Additionally, some plans offer tiered pricing, where generic drugs have the lowest co-pay, brand-name generics are slightly higher, and specialty medications carry the highest cost. Understanding these tiers helps families make informed choices about treatment options without sacrificing financial stability.

Preemptive Moves: Using Prevention to Cut Future Costs

One of the most effective ways to reduce medical spending is also one of the simplest: prevent illness before it starts. Preventive care is not just a health strategy—it’s a financial safeguard. Routine screenings, vaccinations, and wellness visits are often fully covered by insurance under the Affordable Care Act, meaning patients can access them at no additional cost. Yet many people skip these services, either due to time constraints, lack of awareness, or the belief that they’re unnecessary when feeling well. This short-term convenience can lead to long-term financial consequences.

Consider the example of colorectal cancer screening. When detected early through a colonoscopy, the condition is highly treatable, with survival rates exceeding 90%. But if left undiagnosed until symptoms appear, treatment becomes far more complex and expensive, often involving surgery, chemotherapy, and extended hospital stays. The difference in cost can be tens of thousands of dollars—and that’s not including the emotional and physical toll. Similarly, managing high blood pressure through regular check-ups and medication adherence can prevent strokes, heart attacks, and kidney disease, all of which carry massive medical price tags.

Wellness programs offered through employers or insurers also play a valuable role. These may include free biometric screenings, smoking cessation support, weight management coaching, or fitness incentives. Participating not only improves health but can also reduce insurance premiums or earn rewards. For children and older adults, staying up to date on immunizations prevents costly illnesses like pneumonia, influenza, and shingles. Dental care, often overlooked in health planning, is another area where prevention pays off. Regular cleanings and check-ups can prevent gum disease and tooth decay, avoiding the need for root canals, extractions, or dentures.

The financial logic of prevention is supported by research. A study published in the journal Health Affairs found that increased use of preventive services was associated with lower overall medical spending over time, particularly for high-risk populations. While not every condition can be prevented, early detection and proactive management significantly reduce the likelihood of catastrophic expenses. The message is clear: investing time in prevention today can spare families from much larger financial burdens tomorrow.

Investing with Healthcare Risks in Mind

As individuals approach midlife and retirement, the intersection of health and wealth becomes impossible to ignore. Medical expenses tend to rise with age, and without proper planning, even well-funded retirement accounts can be depleted by long-term care costs, chronic disease management, or extended hospital stays. This is why personal investing should not be viewed in isolation from health risk. A diversified portfolio is not just a tool for growth—it’s a buffer against unexpected medical shocks.

One approach is to incorporate healthcare costs into long-term financial projections. Financial planners often estimate that a healthy 65-year-old couple retiring today may need $300,000 or more to cover out-of-pocket medical expenses throughout retirement, excluding long-term care. This includes premiums for Medicare Part B and Part D, supplemental insurance, dental, vision, and hearing services, as well as co-pays and uncovered treatments. Building these estimates into retirement planning helps ensure that savings are sufficient to maintain quality of life without forcing difficult trade-offs.

Investment strategies should also reflect changing health needs over time. In younger years, when medical costs are typically lower, a more aggressive allocation to stocks may be appropriate to maximize growth. As retirement nears, a gradual shift toward more conservative assets—such as bonds or fixed-income funds—can help preserve capital. However, complete withdrawal from equities may not be advisable, as inflation can erode the purchasing power of cash over decades. A balanced approach that maintains some growth potential while managing risk is often the most sustainable.

Long-term care insurance is another consideration, though it requires careful evaluation. Premiums can be high, and benefits may not be needed if health remains stable. Some families choose to self-insure by setting aside dedicated savings or using hybrid life insurance policies that include long-term care riders. There is no one-size-fits-all solution, but the important step is to acknowledge that health-related financial risk is a real and growing part of retirement planning. Ignoring it can lead to vulnerability when it’s least affordable.

Putting It All Together: A Realistic Financial Game Plan

Managing medical costs in today’s complex environment doesn’t require radical changes—it requires consistent, thoughtful actions. The first step is to assess personal and family risk. How many people depend on your income? What is your current health status? Do you have a history of chronic conditions? Answering these questions helps determine how much financial protection is needed. From there, building a layered defense makes sense: using insurance wisely, maximizing tax-advantaged accounts like HSAs, prioritizing prevention, and aligning investment choices with long-term health expectations.

A practical starting point is to create a health finance calendar. Mark deadlines for open enrollment, HSA or FSA contributions, and annual wellness visits. Schedule screenings based on age and family history. Track medical expenses monthly to identify patterns and opportunities for savings. Many families find that simply reviewing bills and questioning unclear charges leads to corrections and reductions. Negotiating cash prices for procedures, especially when paying out of pocket, can also yield significant discounts—some providers offer 20% to 40% off billed rates for prompt payment.

Equally important is cultivating financial discipline. It’s easy to deprioritize health savings when other expenses compete for attention. But treating medical preparedness as non-negotiable—like housing or food—shifts the mindset from reactive to proactive. Even small, regular contributions to an HSA or dedicated savings account build resilience over time. The goal isn’t perfection; it’s progress. Mistakes will happen, plans will change, and new challenges will emerge. What matters is maintaining awareness and adjusting course as needed.

Finally, remember that control comes not from predicting every medical event, but from preparing for the possibility of them. No one can eliminate risk, but everyone can reduce its impact. By understanding market trends, leveraging available tools, and making informed choices, families can navigate the uncertainties of healthcare with greater confidence. The peace of mind that comes from knowing you’ve taken sensible steps is invaluable—and often the best return on any investment.