When the Unexpected Hits: Why Timing Your Investments in Healthcare Protection Matters

Life doesn’t send warnings before things go sideways. A sudden injury, an urgent medical procedure, or a loved one’s emergency can flip your finances upside down in hours. I learned this the hard way—after skipping “unnecessary” protections, I faced a bill that made my stomach drop. That moment changed how I see investing. It’s not just about growing wealth; it’s about timing your moves so you’re shielded when life throws a curveball. Let me walk you through how smart, timely decisions can protect both health and finances. Financial planning often focuses on returns, savings goals, and retirement timelines—but too many overlook the one risk that can erase years of progress in days: a serious health event. The truth is, the cost of waiting is rarely measured in premiums saved. It’s measured in peace of mind lost, in assets liquidated under pressure, and in dreams quietly set aside. This article explores how aligning healthcare protection with financial strategy isn’t an optional add-on—it’s a cornerstone of lasting stability.

The Blind Spot in Financial Planning: Ignoring Health-Linked Risks

Most financial plans assume steady progress—consistent income, gradual savings growth, and predictable expenses. Yet, this model rarely accounts for sudden health disruptions, which remain one of the most common causes of financial distress. Medical emergencies do not discriminate by income level; even families with stable jobs and solid savings can find themselves overwhelmed by unexpected costs. A broken bone, a sudden hospitalization, or a chronic illness diagnosis can trigger a chain reaction: medical bills accumulate, work hours are reduced, and investment contributions pause. In many cases, individuals dip into retirement funds or take on high-interest debt to cover immediate needs, derailing long-term goals.

The impact is not limited to direct medical costs. Indirect expenses such as transportation to treatments, home modifications, or hiring temporary help for household tasks add hidden layers of financial strain. According to studies, a significant percentage of personal bankruptcies in certain countries are linked to medical expenses, even among those with insurance. This reveals a critical gap: having coverage does not always mean being protected. Gaps in policy terms, deductibles, co-pays, and non-covered treatments can leave families exposed. The problem is not just the event itself, but the timing—when an emergency strikes during a vulnerable financial phase, such as paying off a mortgage or funding a child’s education, the consequences multiply.

Traditional financial planning often treats health risks as static assumptions rather than dynamic threats. For example, someone might assume they are “healthy now,” so deferring coverage is a low-risk choice. But health is inherently uncertain, and the financial system rarely offers grace periods. When a crisis hits, banks do not pause loan payments, and investment markets do not wait for recovery. This mismatch between expectation and reality creates a blind spot—one that can erode decades of disciplined saving in a matter of weeks. Recognizing this vulnerability is the first step toward building a more resilient financial life, one that anticipates disruption rather than reacting to it.

What Is Investment Timing—and Why It’s More Than Market Moves

When most people hear “investment timing,” they think of stock market entries and exits—buying before a rally, selling before a downturn. But true investment timing goes beyond market fluctuations. It involves aligning financial decisions with life stages, personal risks, and potential disruptions. In this broader sense, timing your investments includes deciding when to secure protection, not just when to buy assets. A well-timed decision to obtain healthcare coverage can preserve capital, maintain cash flow, and prevent forced sales of investments at inopportune moments.

Consider two individuals with similar incomes and savings habits. One purchases comprehensive health protection early, while the other delays, assuming they are unlikely to need it. When both face a serious medical issue five years later, their outcomes differ drastically. The first person uses insurance to cover treatment, continues contributing to investments, and maintains financial momentum. The second faces out-of-pocket costs, borrows money, and halts retirement contributions. Though both had the same earning potential, the difference in timing created a lasting divergence in wealth accumulation. This illustrates that investment timing is not just about market precision—it’s about risk alignment.

Proactive planning shifts the focus from reaction to resilience. Waiting until a health issue arises to seek coverage often means higher premiums, exclusions for pre-existing conditions, or outright denial of coverage. In contrast, acting early locks in favorable terms and ensures continuity. This strategic foresight transforms protection from a cost into a safeguard for future growth. It also reduces emotional decision-making during crises, allowing families to focus on healing rather than financial survival. Investment timing, therefore, is not speculation—it is discipline. It means recognizing that financial strength is not just measured by portfolio size, but by the ability to withstand shocks without derailing long-term goals.

The Hidden Cost of Waiting: How Delaying Protection Backfires

Postponing healthcare protection may appear to save money in the short term, but the long-term consequences often outweigh any immediate gains. One of the most significant hidden costs is the rise in premiums with age. Insurance products, especially those covering critical illness or disability, are priced based on risk factors such as age and health status. A healthy 35-year-old might pay half the monthly premium of someone applying at 50, even for the same level of coverage. By delaying, individuals effectively pay more for the same protection, reducing the value of their financial planning over time.

Beyond higher costs, waiting increases the risk of exclusion or denial. Many policies assess applicants based on current health, and a new diagnosis—even a manageable one like high blood pressure or diabetes—can result in limited coverage or higher rates. In some cases, individuals who delay may find themselves uninsurable when they need it most. This creates a dangerous paradox: the people who most need protection are often the least able to obtain it. Additionally, coverage gaps leave individuals exposed during transitional periods, such as between jobs or after life changes like marriage or parenthood, when healthcare needs may increase.

Another consequence of delay is the forced liquidation of assets. Without protection, a medical emergency often requires drawing from savings or selling investments. If markets are down, this means realizing losses rather than waiting for recovery. Even in stable markets, selling assets interrupts compounding growth. A $20,000 withdrawal at age 45 could result in over $100,000 in lost future value by retirement, assuming average market returns. These opportunity costs are rarely visible on a balance sheet but have a profound impact on long-term financial health. Delaying protection, therefore, is not a neutral choice—it is a bet against uncertainty, and one that frequently loses.

Building a Financial Safety Net: Integrating Insurance and Investment Strategies

True financial strength comes from integrating protection and growth, not treating them as separate concerns. A well-structured financial plan includes both investment vehicles for wealth accumulation and insurance tools for risk mitigation. When combined, they create a balanced system where growth is protected, and setbacks are manageable. The goal is not to eliminate risk—this is impossible—but to control its financial impact. This integration begins with understanding the role of different protection tools and how they interact with investment strategies.

Critical illness insurance, for example, provides a lump-sum payment upon diagnosis of covered conditions such as cancer, heart attack, or stroke. Unlike traditional health insurance, which reimburses medical providers, this benefit goes directly to the policyholder, offering flexibility in use. Funds can cover treatment not included in standard plans, replace lost income during recovery, or prevent the need to sell investments. When paired with a diversified investment portfolio, this coverage acts as a shock absorber, preserving capital during crises. Similarly, disability insurance ensures a portion of income continues if an individual cannot work due to illness or injury, maintaining cash flow without disrupting long-term savings.

Equally important is the emergency fund, typically recommended at three to six months of essential expenses. While not an investment in the traditional sense, it serves as a first line of defense, preventing minor setbacks from becoming major financial events. When combined with insurance, it creates layered protection: the emergency fund handles short-term disruptions, while insurance covers larger, long-term risks. Investment vehicles such as health savings accounts (HSAs) in eligible regions further enhance this integration by offering tax advantages for medical expenses while allowing unused funds to grow over time. These accounts blur the line between protection and investment, embodying the principle that financial resilience comes from alignment.

The key is coordination. A portfolio may be well-diversified across asset classes, but if it lacks protection against income interruption or high medical costs, it remains vulnerable. By intentionally designing a plan where insurance supports investment goals, individuals create a more durable financial foundation. This does not mean over-insuring or overspending on premiums; it means selecting coverage that matches actual risks and integrates smoothly with existing strategies. The result is not just security, but sustained growth—even in the face of adversity.

Real Signals, Not Guesswork: Recognizing Personal Triggers for Action

Timing protection decisions does not require predicting the future. Instead, it involves paying attention to personal life changes that signal increased vulnerability. These triggers are not market indicators but life events that shift risk exposure. Recognizing them allows individuals to act with purpose rather than panic. Some of the most common signals include career transitions, such as starting a business, changing jobs, or reducing work hours. These shifts often bring changes in employer-sponsored benefits, creating gaps in coverage that may go unnoticed until it’s too late.

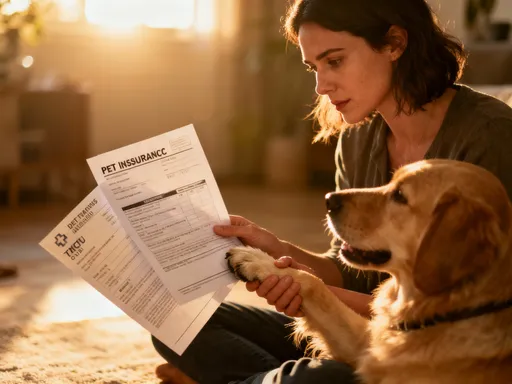

Family changes are equally significant. The arrival of a child, marriage, or taking on caregiving responsibilities for aging parents all increase financial dependency and potential healthcare needs. A newborn may require specialized care, a spouse may rely on dual income, and elderly parents may face chronic conditions that demand attention and resources. These moments are not just emotional milestones—they are financial inflection points. Acting during these transitions ensures that protection keeps pace with evolving responsibilities.

Physical and mental health changes also serve as important cues. Persistent fatigue, new diagnoses, or increasing stress levels may indicate that the body is under strain. While not always a sign of serious illness, they suggest a need to review existing safeguards. Similarly, approaching key age thresholds—such as 40, 50, or 60—often coincides with higher health risks and rising insurance costs. Using these milestones as prompts for review helps prevent last-minute decisions under pressure. The goal is not to live in fear of illness, but to acknowledge that life changes, and financial plans should change with it. By treating these signals as opportunities rather than threats, individuals take control of their financial destiny.

Case Study: From Crisis to Control—How One Family Regained Stability

This story follows a family of four—Mark, a project manager, his wife Sarah, a part-time teacher, and their two children. They lived in a mid-sized city, owned a modest home, and had been saving consistently for retirement and college. They believed they were financially secure—until Mark suffered a sudden heart attack at age 48. The medical event required emergency surgery, a week in intensive care, and three months of recovery during which he could not work. Though they had health insurance, it covered only a portion of the costs. Additional expenses included medication, follow-up treatments, and transportation to appointments. Sarah reduced her hours to help manage the household, cutting their combined income by nearly 40%.

Within six months, they had drained their emergency fund, withdrawn $15,000 from a retirement account (incurring taxes and penalties), and accumulated $8,000 in credit card debt. Their investment contributions stopped, and they considered selling a rental property at a loss. The emotional toll was just as heavy—constant worry about money made recovery harder. It was only after meeting with a financial advisor that they realized their plan had a critical flaw: they had focused on growth but neglected protection. They had no critical illness or disability coverage, assuming their employer benefits were sufficient.

The turning point came when they restructured their plan. They paid off high-interest debt through a consolidation loan, resumed retirement contributions at a reduced level, and established a new emergency fund. More importantly, they added critical illness insurance and updated their disability coverage to reflect their current income and needs. They also reviewed their investment portfolio to ensure it remained aligned with long-term goals. Over the next three years, as Mark returned to work and their finances stabilized, they rebuilt their savings and regained confidence. The experience did not erase the hardship, but it transformed their approach. They now view protection not as an expense, but as essential infrastructure—like a seatbelt in a car. It doesn’t prevent accidents, but it increases the chance of arriving safely.

Your Move: Aligning Protection with Long-Term Wealth Goals

The story of Mark and Sarah is not unique. Thousands of families face similar challenges every year, not because they lack discipline, but because their plans lack balance. True wealth is not just the number in an account—it is the ability to withstand life’s disruptions without losing ground. This requires a shift in mindset: viewing healthcare protection not as a separate cost, but as a strategic investment in financial continuity. When timed well, these decisions preserve capital, maintain cash flow, and protect long-term growth. They turn moments of crisis into opportunities for resilience.

Acting early is not about fear—it is about foresight. The best time to secure protection is before it’s needed, when health is stable, premiums are lower, and options are available. Waiting for a warning sign is a gamble with high stakes. Instead, use life changes as natural prompts to review and adjust. Whether it’s a new job, a growing family, or a milestone birthday, these moments offer a chance to strengthen the foundation. The goal is not perfection, but progress—building a plan that evolves with life’s stages.

In the end, financial success is not measured only by returns achieved, but by stability maintained. A well-timed decision to invest in protection can be just as valuable as a well-timed stock purchase. It ensures that when the unexpected hits, the response is not panic, but confidence. It means knowing that savings are preserved, investments continue to grow, and family well-being remains intact. This is the power of alignment—of matching financial strategy with real-life risks. The next unexpected moment will come. The question is not if, but whether you will be ready. By acting now, with clarity and purpose, you can build a future that is not just prosperous, but protected.