Weathering the Storm: Smart Money Moves When Nature Strikes

What happens to your finances when the ground starts shaking or the skies turn violent? I learned the hard way during a major flood—my emergency fund saved me, but my investments were a mess. Natural disasters don’t just destroy homes; they shake portfolios too. That’s why I rebuilt my financial strategy with risk control at the core. This is how I protect my money before disaster hits—and how you can too. Financial resilience isn’t about predicting the next hurricane or earthquake. It’s about preparing for uncertainty, minimizing exposure, and ensuring access to resources when systems fail. The most dangerous threat isn’t the storm itself, but the financial chaos that follows.

The Hidden Financial Earthquake

Natural disasters unleash more than physical destruction—they trigger a silent financial crisis that begins long before the first tree falls or the first levee breaks. When a hurricane approaches, businesses close, workers miss shifts, and income stops. Banks may suspend operations, ATMs run dry, and digital payment systems fail. In the days following Hurricane Ian in 2022, thousands of Floridians found themselves unable to access their accounts due to power outages and network disruptions. Meanwhile, emergency expenses surged: temporary housing, medical care, fuel, and repairs quickly drained savings. This pattern repeats across flood zones, wildfire regions, and earthquake-prone areas. The financial impact is not limited to property damage—it extends to cash flow paralysis, credit strain, and long-term debt accumulation.

Most households are unprepared for this cascade of financial stress. A 2023 Federal Reserve report found that only 37% of Americans could cover a $400 emergency without borrowing or selling assets. When disaster strikes, even those with savings often discover their funds are inaccessible or insufficient. Traditional financial planning focuses on retirement, college, and wealth growth—but rarely on crisis continuity. People assume their bank accounts will always be available, their paychecks will keep coming, and their insurance will cover losses. These assumptions collapse in a disaster zone. Power outages disable online banking. Evacuations prevent access to physical branches. Job sites shut down. The result is a financial blackout just when liquidity is needed most.

The root cause of this vulnerability lies in centralized financial structures. Most families keep their money in one or two accounts, store documents at home, and rely on a single income source. When any part of this system fails, the entire financial foundation trembles. A wildfire can destroy not only a house but also the filing cabinet containing insurance policies, birth certificates, and bank statements. Without backups, recovering becomes exponentially harder. This section underscores a critical truth: risk control in personal finance is not a luxury—it is a survival mechanism. The goal is not to avoid all loss, which is impossible, but to reduce exposure and maintain functionality when systems fail. Understanding the nature of these hidden financial shocks is the first step toward building true resilience.

Building a Disaster-Proof Financial Foundation

A strong financial foundation withstands disruption much like a well-engineered home resists high winds. Just as builders use reinforced frames and impact-resistant glass, individuals must construct financial systems that endure crisis. The cornerstone of this structure is decentralization. Relying on a single bank, a single account, or a single location for financial records creates a single point of failure. When that point collapses, recovery slows dramatically. Instead, financial resilience begins with redundancy—spreading assets, access methods, and documentation across multiple secure channels.

Cash reserves are essential, but they must be strategically distributed. Keeping all emergency funds in a checking account tied to a local branch is risky if that branch closes. A better approach is to maintain liquidity in multiple forms: a primary emergency fund in a high-yield savings account with nationwide ATM access, a secondary reserve in a credit union in a different region, and a small amount of physical cash stored in a fireproof, waterproof safe. This layered approach ensures that even if one system fails, others remain operational. For families, it is equally important to establish clear access protocols. Spouses, adult children, or trusted relatives should know how to log into accounts, locate documents, and withdraw funds if the primary earner is unavailable.

Digital preparedness is just as crucial. Vital records—insurance policies, property deeds, tax returns, and identification—should be scanned and stored in encrypted cloud storage with two-factor authentication. Services like Google Drive, Dropbox, or specialized financial vaults offer secure, remote access from any device with internet connectivity. Families should conduct quarterly reviews to ensure all documents are up to date and accessible. Additionally, maintaining a printed copy of critical information in a portable, durable container allows for quick evacuation. The objective is not complexity, but continuity: ensuring that financial identity and access survive even if the physical home does not.

Geographic diversification of assets further strengthens this foundation. For those with investments, holding accounts with institutions in different regions reduces the risk of simultaneous disruption. A brokerage account based in California may remain functional during a Gulf Coast hurricane, just as a bank in the Midwest can operate normally during a Pacific earthquake. This geographic buffer ensures that administrative tasks—transferring funds, selling securities, or filing claims—can continue uninterrupted. By treating financial infrastructure with the same care as physical infrastructure, families create a system that supports recovery rather than hinders it.

Investment Shields: Protecting Portfolios from Natural Shocks

Disasters do not affect all investments equally. While some assets plummet in value, others remain stable or even gain. Understanding these patterns allows investors to build portfolios that absorb shocks rather than fracture under pressure. The key is not to chase high returns during crises, but to prioritize stability, liquidity, and sector resilience. A well-structured portfolio acts as a shield, preserving capital so it can be deployed when recovery begins.

Stock markets often react unpredictably to natural disasters. In the short term, regional companies—especially in tourism, retail, and construction—may see sharp declines. After Hurricane Katrina, New Orleans-based businesses faced months of operational paralysis, dragging down local equity values. However, national utilities, healthcare providers, and infrastructure firms often hold steady or rebound quickly due to consistent demand. Investors with diversified exposure across sectors and regions are better insulated from localized downturns. International holdings can also provide balance, as global markets may remain unaffected by domestic events.

Bonds, particularly government-issued securities, tend to perform well during periods of uncertainty. U.S. Treasury bonds are considered safe-haven assets, meaning investors flock to them during crises. This increases demand and supports prices, even as equities fluctuate. Municipal bonds, however, may face pressure if the issuing city is directly impacted by a disaster. Real estate investments require careful evaluation: physical properties in high-risk zones—coastal areas, wildfire-prone forests, floodplains—carry inherent vulnerability. Rental income can vanish overnight if tenants evacuate or buildings become uninhabitable. Yet real estate in stable, inland locations may retain value and provide long-term income.

Commodities like gold and silver often rise in value during disasters, serving as inflation hedges and stores of value when confidence in paper assets wanes. However, they do not generate income and require secure storage. A balanced approach includes a modest allocation to precious metals within a broader diversified portfolio. The goal is not speculation, but stabilization. By combining low-volatility bonds, resilient equities, and a small hedge in commodities, investors create a mix that prioritizes capital preservation. This “shock-resistant” portfolio may not deliver rapid growth, but it ensures that wealth survives to fund recovery when the storm passes.

The Liquidity Lifeline: Access When Banks Freeze

When power grids fail and communication networks go down, digital money becomes useless. ATMs stop dispensing cash, credit card terminals go dark, and mobile payment apps fail. In these moments, physical currency becomes the only reliable medium of exchange. Yet most families keep little or no cash on hand, assuming electronic systems will always function. This dependence creates a dangerous gap between need and access. The solution is not to abandon digital banking, but to maintain a strategic reserve of liquid assets that work when technology does not.

Experts recommend keeping one to two weeks of essential expenses in cash, stored securely but accessibly. For a typical household, this might mean $500 to $1,500 in small denominations—$1, $5, and $10 bills—that can be used for food, fuel, transportation, and small repairs. This cash should be rotated every six months to prevent deterioration and stored in a fireproof, waterproof container away from obvious locations like a wallet or desk drawer. Some families use lockboxes in basements or closets; others prefer off-site storage with a trusted relative in a low-risk area. The goal is to ensure that funds are available even if evacuation is necessary.

Prepaid debit cards offer another layer of protection. Loaded with a set amount, these cards can be used like credit cards but do not require a bank connection in real time. They are especially useful for online purchases if home internet is down but mobile data remains. Unlike credit cards, they do not create debt, and unlike bank-linked cards, they are not subject to account freezes. Mobile wallets like Apple Pay or Google Pay can function offline for limited transactions, but only if the device is charged and the merchant accepts contactless payments. A combination of cash, prepaid cards, and charged mobile devices creates a multi-channel liquidity strategy.

The key is balance. Keeping too much cash at home invites theft or loss; keeping too little leaves families stranded. The ideal mix depends on location, household size, and risk exposure. Coastal residents may need more liquidity due to frequent storm disruptions, while inland families might rely more on digital access. Regular drills—such as simulating a week without internet or power—help identify gaps and refine the approach. Liquidity is not just about money; it is about maintaining agency when systems fail.

Insurance as a Risk Lever, Not a Guarantee

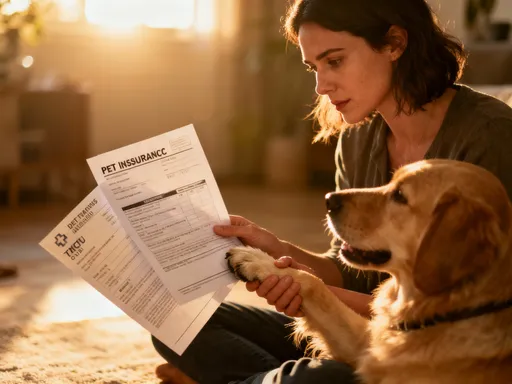

Many people believe insurance is a safety net that automatically covers disaster losses. The reality is far more complex. Policies contain exclusions, limits, and conditions that often leave policyholders undercompensated when they need help most. Standard homeowners insurance, for example, typically does not cover flood damage. A family in a flood zone must purchase a separate flood policy through the National Flood Insurance Program (NFIP), which has coverage caps and long processing times. After Hurricane Harvey, thousands of claims were delayed for months, leaving families without funds to rebuild.

Similarly, wildfire coverage may exclude certain building materials or require mitigation measures like fire-resistant roofing. Earthquake insurance is often sold as an add-on, not included in standard policies, and can be prohibitively expensive in high-risk areas. Even when coverage exists, claims can be denied due to documentation gaps, disputed damage assessments, or failure to meet policy requirements. During mass disaster events, insurers may delay processing due to overwhelming volume, further slowing recovery.

The smart approach is to treat insurance not as a guarantee, but as a risk management tool—one that transfers some financial exposure in exchange for a premium. To use it effectively, policyholders must conduct regular audits. This means reviewing all policies annually, understanding what is and is not covered, and closing gaps with additional riders or separate policies. For example, a personal property rider may be needed for high-value items like jewelry or art, which often have low default limits. Umbrella liability insurance can provide extra protection against lawsuits arising from accidents during or after a disaster.

Health insurance is another critical component. Medical emergencies increase during disasters—falls during cleanup, respiratory issues from smoke, or injuries from debris. High-deductible plans may leave families facing large out-of-pocket costs. Supplemental insurance, such as critical illness or accident coverage, can help bridge the gap. The goal is not to eliminate all risk—impossible in nature’s unpredictability—but to make informed choices about which risks to retain and which to transfer. Insurance, when properly structured, becomes a lever that reduces financial vulnerability without creating false confidence.

Recovery Without Ruin: Financing the Comeback

Rebuilding after a disaster is a marathon, not a sprint. Costs often exceed initial estimates, and timelines stretch far beyond expectations. A roof repair that seems minor may reveal structural damage. Temporary housing can turn into months of rental payments. Families face tough financial decisions: Should they tap retirement accounts? Take out a loan? Sell investments at a loss? The choices made in the early stages of recovery can have long-term consequences. Acting out of panic—such as selling stocks at a market low or taking high-interest payday loans—can deepen financial strain rather than alleviate it.

Smart recovery financing follows a staged approach. The first priority is to use emergency funds and insurance proceeds to cover immediate needs: shelter, food, medical care, and essential repairs. If these are insufficient, low-interest disaster loans from government agencies like the Small Business Administration (SBA) offer a better alternative than credit cards or personal loans. SBA disaster loans provide favorable terms, including deferred payments and fixed interest rates, making them a responsible option for larger expenses. However, approval can take weeks, so they should not be the first line of defense.

Withdrawing from retirement accounts like 401(k)s or IRAs should be a last resort. Early withdrawals before age 59½ typically incur a 10% penalty and are subject to income tax, eroding decades of growth. The CARES Act introduced exceptions for disaster-related withdrawals, but these are not permanent. A better strategy is to explore hardship distributions or plan loans, which allow temporary access without triggering penalties, provided the funds are repaid. Even then, borrowing from retirement savings reduces future compounding and increases long-term risk.

Investment sales require careful timing. Selling assets during a market downturn locks in losses and delays recovery. A more sustainable approach is to hold diversified, income-generating assets that can provide cash flow without liquidation. Dividend-paying stocks, rental properties, or bond interest can help fund recovery over time. The focus should be on preserving capital while restoring stability. Recovery is not about returning to the past, but building a stronger financial future through disciplined, informed choices.

The Mindset of Financial Resilience

True financial resilience begins in the mind. No amount of savings, insurance, or diversified investments can protect against poor decision-making under stress. Fear, uncertainty, and urgency cloud judgment, leading to impulsive actions—panic selling, overspending on temporary fixes, or avoiding necessary repairs. Behavioral finance shows that people often make worse financial choices during crises because they shift from long-term thinking to short-term survival mode. The antidote is preparation: not just financial plans, but mental readiness.

Planning reduces anxiety by replacing uncertainty with structure. When families have a clear disaster response checklist—knowing where documents are, how much cash to take, which accounts to access—they act with confidence rather than fear. Regular financial drills, such as simulating a power outage or reviewing insurance policies together, build familiarity and reduce panic. These exercises reinforce habits, making the right actions automatic when real crises occur.

Emotional discipline is just as important as financial discipline. Accepting that some loss is inevitable allows for more rational decision-making. Rather than chasing perfect recovery, resilient individuals focus on progress. They set realistic milestones—securing shelter, restoring income, rebuilding credit—and celebrate small wins. They also seek support, whether from financial advisors, community programs, or family networks, avoiding the isolation that worsens financial stress.

In the end, financial resilience is not about having the perfect plan. It is about having a flexible, informed, and practiced approach that adapts to changing circumstances. It is about knowing that while nature cannot be controlled, financial outcomes can be managed. By combining practical strategies with emotional strength, families can weather any storm—not just survive, but emerge stronger.