Paws & Profits: My Real Talk on Smart Pet Health Investing

You know that feeling when your dog stares at you with those big, trusting eyes? Yeah, me too. And lately, I’ve started seeing vet bills not just as expenses—but as investment signals. Turns out, putting thought into pet health products isn’t just about love; it’s about strategy. I tested this mindset, tracked the outcomes, and honestly? It changed how I spend and plan. Let me walk you through what really works. What began as a simple effort to reduce surprise vet costs turned into a full financial shift—recognizing that every choice, from food to flea treatment, carries long-term implications. This isn’t about cutting corners on care. It’s about making smarter decisions so your pet thrives and your budget stays intact. The emotional bond we share with our pets is real, but the financial impact of that bond deserves equal attention.

The Hidden Cost of Loving Your Pet

Pet ownership is often sold as a joyful, uncomplicated addition to family life. Yet behind the wagging tails and cozy cuddles lies a financial reality many are unprepared for. The average dog owner spends between $1,500 and $2,500 annually on care, while cat owners typically spend $1,000 to $1,800, not including emergencies. These numbers climb quickly when chronic conditions emerge. A single diagnosis of diabetes or kidney disease in cats can lead to monthly costs exceeding $200 in medication, monitoring, and vet visits. For dogs, hip dysplasia or arthritis treatments can total thousands over time, especially if surgery becomes necessary. These aren’t rare edge cases—they’re common outcomes of aging pets, and they catch families off guard because the early signs are subtle and the spending creeps in gradually.

What starts as a small supplement purchase or an over-the-counter ear cleaner can evolve into a pattern of reactive spending. Pet owners often respond to symptoms rather than prevent them, leading to higher cumulative costs. For instance, skipping dental care might save $300 on a cleaning today, but untreated periodontal disease can result in tooth extractions, antibiotics, and even heart or kidney complications down the line—costing ten times more. Emotional decision-making plays a major role. When a pet seems unwell, the instinct is to “do something,” even if that something is unnecessary or ineffective. Marketing amplifies this: phrases like “veterinarian-recommended” or “clinically proven” are used loosely, leading owners to believe a pricier product is inherently better. But without understanding ingredients or evidence, that premium price may only buy peace of mind, not better health.

The financial burden isn’t just in medical bills. Preventative products themselves can become a hidden drain. Monthly flea and tick preventatives, heartworm medication, joint supplements, and specialty diets add up. When purchased without evaluation, these items form a recurring cost that few budget for. One study found that over 40% of pet owners do not track their pet-related expenses separately, blending them into general household spending until a crisis reveals how much has been flowing out. This lack of visibility makes it hard to adjust behavior. The result? A cycle of stress and surprise, where love is expressed through spending, but the long-term consequences aren’t considered. Recognizing this pattern is the first step toward breaking it.

Why Pet Health Is an Investment, Not Just an Expense

Reframing pet care as an investment shifts the entire financial conversation. Instead of viewing each vet visit or supplement bottle as a loss, owners begin to see them as deposits in their pet’s health account. Like compound interest, small, consistent investments today can yield significant returns in the form of fewer emergencies, slower disease progression, and a longer, more vibrant life. Consider the cost of treating Lyme disease in dogs: diagnosis, antibiotics, blood work, and follow-up visits can exceed $1,000. In contrast, a year’s supply of effective tick prevention averages $150 to $300. That’s a seven-to-one return on investment, not to mention the discomfort and risk avoided for the pet.

The concept of health ROI—return on investment—is not abstract. It’s measurable in both dollars and quality of life. Preventive dental care is another strong example. A professional cleaning under anesthesia might cost $300 to $600, depending on location and pet size. But when done annually, it drastically reduces the likelihood of advanced dental disease, which can require extractions at $800 to $1,500 or more. More importantly, oral health is linked to systemic issues: bacteria from gum disease can enter the bloodstream and affect the heart, liver, and kidneys. By investing in cleanings and daily brushing, owners aren’t just saving on future vet bills—they’re protecting their pet’s overall well-being.

Nutrition is perhaps the most powerful form of pet health investment. High-quality diets rich in bioavailable proteins, balanced fats, and essential nutrients support immune function, skin and coat health, joint integrity, and digestive stability. While premium food may cost $30 to $60 more per month than budget brands, the downstream benefits are clear. Pets on consistent, species-appropriate diets are less likely to develop food allergies, obesity, or gastrointestinal disorders—all of which drive up medical costs. One longitudinal survey of over 2,000 pet owners found that those feeding veterinarian-approved diets reported 35% fewer vet visits annually compared to those using generic or store-brand foods. This isn’t about luxury; it’s about efficiency. Every dollar spent wisely on food is a dollar not spent on treatment later.

Regular veterinary checkups, often dismissed as unnecessary for “healthy” pets, are another high-yield investment. Annual or biannual wellness exams allow for early detection of conditions like thyroid imbalances, early kidney dysfunction, or heart murmurs. Catching these issues in stage one or two means they can often be managed with diet, low-cost medication, and monitoring. Waiting until symptoms appear usually means the disease has progressed, requiring more aggressive—and expensive—interventions. The average cost of a routine exam is $50 to $100. The average cost of managing advanced kidney disease in cats exceeds $1,200 per year. The math speaks for itself. Viewing vet visits as maintenance, not emergencies, transforms pet ownership from crisis management to strategic stewardship.

Spotting the Winners: How to Choose High-Value Pet Health Products

With thousands of pet health products on the market, making value-based choices requires discipline and a clear framework. The first step is understanding that not all products are regulated equally. Unlike human pharmaceuticals, most pet supplements and nutraceuticals are not subject to pre-market approval by regulatory bodies. This means manufacturers can make broad claims without rigorous proof. To cut through the noise, owners must become informed evaluators. Start by reading ingredient labels carefully. Look for specific protein sources—like “chicken meal” instead of “meat by-products”—and avoid vague terms like “flavor” or “animal digest.” In supplements, active ingredients should be listed with exact amounts, not hidden in proprietary blends.

Scientific backing is another critical filter. A high-value product will often reference clinical studies, even if only in summary form. While peer-reviewed research in veterinary medicine is limited, some ingredients have strong evidence. For example, glucosamine and chondroitin have been studied extensively for joint health in dogs, with multiple trials showing improved mobility and reduced pain in arthritic animals. Omega-3 fatty acids, particularly EPA and DHA from fish oil, are proven to reduce inflammation and support cognitive function. Probiotics containing strains like Bacillus coagulans or Enterococcus faecium have demonstrated benefits for digestive health. When a product highlights these ingredients with transparent dosing, it’s more likely to deliver results.

Veterinarian endorsement carries weight, but it must be genuine. Be cautious of products labeled “vet-approved” without clarification. Does the vet own the brand? Are they paid to promote it? True endorsement comes from unbiased professionals who recommend products based on patient outcomes, not commissions. Some veterinary hospitals carry only products they’ve vetted through clinical experience—these are often more reliable than mass-market options. Additionally, look for third-party certifications. Organizations like the National Animal Supplement Council (NASC) require member companies to follow good manufacturing practices and report adverse events. While not a guarantee of efficacy, NASC membership signals a level of accountability.

Real-world testing is also part of the evaluation process. A product might look good on paper, but if your pet won’t eat it or develops digestive upset, it’s not valuable. Introduce new supplements or foods gradually and track changes in energy, coat condition, stool quality, and behavior. Keep a simple log for 4 to 6 weeks. If no improvement is seen, reconsider the investment. The goal is not to try everything, but to build a personalized regimen based on observable results. This approach turns pet care from guesswork into a data-informed practice, aligning spending with actual outcomes.

Building a Pet Health Investment Plan

Just as families plan for college or retirement, they should create a dedicated strategy for pet health financing. The foundation of this plan is a clear understanding of annual needs. Start by listing all recurring expenses: food, preventatives, grooming, and routine vet visits. Then, estimate potential variable costs—dental cleanings, vaccinations, and seasonal treatments. Add a buffer for emergencies: a common rule is to save $500 to $1,000 per pet as a baseline emergency fund. For larger breeds or older animals, this should be higher. Once annual totals are calculated, divide them into monthly amounts and treat them like any other essential bill.

A pet savings account is a practical tool for this. Open a separate account linked to your main banking platform and set up automatic transfers. Even $75 to $150 per month can accumulate quickly. Some owners use cash envelopes or digital budgeting apps to track pet spending separately, increasing awareness and reducing overspending. This structured approach removes the panic of surprise bills and allows for thoughtful decision-making. When a vet recommends a test or treatment, you’re not forced to choose between care and financial strain—you’ve already prepared.

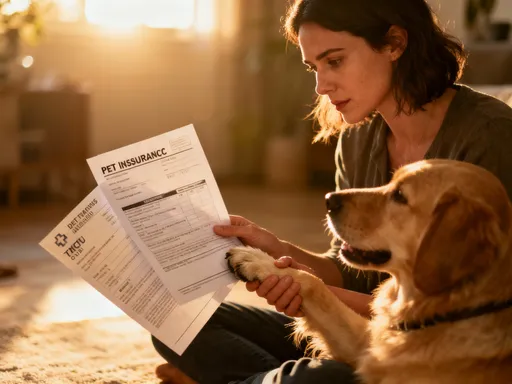

Pet insurance is another component, but it requires careful evaluation. Unlike human health insurance, pet policies are reimbursement-based: you pay upfront and submit claims later. Monthly premiums range from $30 to $80, depending on species, breed, age, and coverage level. Comprehensive plans cover accidents, illnesses, and sometimes hereditary conditions, while basic plans may only cover emergencies. The break-even point varies. For a young, healthy pet, it may take several years of premiums before a major claim offsets the cost. For breeds prone to expensive conditions—like German Shepherds with hip issues or Persians with kidney disease—insurance can be a financial safeguard. However, pre-existing conditions are never covered, so enrolling early is key. Some owners opt for accident-only coverage as a middle ground, reducing premium costs while maintaining protection against trauma.

Budgeting should also align with seasonal risks. Allergy season, for example, often brings skin infections, ear issues, and increased vet visits. Planning ahead by stocking up on approved shampoos, antihistamines, or omega supplements during off-peak months can reduce last-minute spending. Winter demands paw balm, anti-icing products, and possibly indoor enrichment to prevent stress-related behaviors. Mapping these cycles helps smooth out annual costs, turning spikes into predictable line items. The goal is consistency—small, regular investments that prevent large, disruptive expenses.

Risk Control: Avoiding Overpaying and Under-Protecting

Emotional attachment makes pet owners vulnerable to marketing tactics and behavioral biases. One of the most common is over-treatment: using multiple supplements “just in case” or pursuing advanced diagnostics for minor symptoms. While vigilance is good, excess intervention can be costly and even harmful. For example, giving a healthy pet three different joint supplements may not improve outcomes but could lead to digestive issues or drug interactions. Similarly, demanding an MRI for a slight limp—before trying conservative management—can result in bills over $1,500 with little added benefit. The key is balance: being proactive without being reactive.

Marketing exploits this vulnerability. Phrases like “your pet deserves the best” or “don’t risk their health” trigger guilt and urgency. Premium packaging, celebrity endorsements, and “natural” labeling increase perceived value, even when the actual product is comparable to cheaper alternatives. To resist this, adopt a checklist approach. Before purchasing any new product, ask: Is this recommended by my veterinarian? Is there scientific evidence for its use? Does my pet have a diagnosed need for it? Is the ingredient list transparent? Answering these questions creates a filter that separates necessity from noise.

On the flip side, under-protecting is equally dangerous. Some owners skip essentials to save money, such as heartworm prevention or annual exams. But the cost of treating heartworm disease in dogs—ranging from $600 to $1,500—far exceeds the $80 to $150 annual cost of prevention. Skipping vaccines can lead to preventable illnesses with high treatment costs and suffering. The solution is not to cut corners but to prioritize. Focus on core needs first: nutrition, preventive medicine, dental care, and regular vet contact. Once these are secured, consider optional products based on individual pet needs, not trends.

Effective communication with your veterinarian is crucial. Don’t hesitate to ask: “Is this absolutely necessary?” “Are there lower-cost alternatives?” “What happens if we wait?” A good vet will respect these questions and help you weigh risks and benefits. Some clinics offer payment plans or partner with financing services like CareCredit, which can help manage larger expenses without derailing your budget. The goal is informed consent—making decisions based on facts, not fear.

When to Go Premium—And When to Skip It

Not all premium products are worth the price, and not all generics are inferior. The decision should hinge on evidence and need. Prescription diets, for example, are often worth the premium. Formulated for specific conditions like kidney disease, urinary tract health, or food allergies, they undergo rigorous testing and are proven to manage symptoms and slow disease progression. A study published in the Journal of Veterinary Internal Medicine found that cats with chronic kidney disease fed a prescription renal diet lived an average of 1.5 years longer than those on regular food. That kind of outcome justifies the higher cost.

In contrast, over-the-counter dental chews vary widely in effectiveness. Some premium brands contain enzymes or compounds proven to reduce plaque, while others are little more than flavored biscuits. Look for products with the Veterinary Oral Health Council (VOHC) seal, which verifies plaque and tartar control claims. If a $2 chew has the seal and a $5 chew doesn’t, the cheaper option may be the smarter investment. The same logic applies to flea and tick preventatives. Generic versions of active ingredients like fipronil or selamectin are often just as effective as name-brand products, especially when purchased from reputable sources. The key is active ingredient equivalence, not branding.

Mobility aids like orthopedic beds or ramps can improve quality of life for older pets. Here, spending more often pays off in durability and design. A well-constructed ramp that lasts five years is cheaper in the long run than replacing a flimsy one every year. But for items like collars, leashes, or toys, store brands typically perform just as well. The premium price on these is often for aesthetics or branding, not function. By selectively upgrading only where it matters, owners can optimize value across their pet care budget.

The Long Game: Growing Healthier Pets and Smarter Portfolios

Caring for a pet with intention doesn’t just benefit the animal—it strengthens the owner’s financial discipline. The habits formed through pet health investing—budgeting, research, delayed gratification, risk assessment—are transferable to personal finance. Setting aside money each month for vet care mirrors retirement savings. Evaluating product claims mirrors investment due diligence. Avoiding emotional spending mirrors market discipline. Over time, these practices build financial resilience that extends beyond the pet.

Moreover, the emotional rewards of this approach are profound. There’s peace in knowing you’re not just spending, but investing. There’s confidence in making decisions backed by knowledge, not guilt. And there’s joy in watching your pet thrive, not just survive. This isn’t about perfection. It’s about progress—choosing one better food, starting a savings habit, asking one more question at the vet. Each step compounds, just like the benefits of consistent care.

In the end, loving your pet wisely means loving your future self too. The financial stability you build today protects both your household and your ability to care for your companion tomorrow. Pet health isn’t a cost to minimize—it’s a priority to manage. And when approached with strategy, it becomes one of the most meaningful investments you’ll ever make.